Together with the Radix Foundation we are launching the biggest liquidity incentive program on Radix to increase the TVL of DefiPlaza on Radix with wrapped assets.

It is called Project Ignition and it goes live on March 14.

Up to 20% of your liquidity’s USD value will be immediately airdropped to your wallet once you lock your liquidity for 9 to 12 months. To make providing liquidity easier, a total of $10M is available in XRD (the native Radix asset) as counter liquidity, so you only have to provide the wrapped assets.

TLDR;

- Bridge USDC, USDT, ETH, or wBTC from Ethereum to Radix

- Add single-sided liquidity and we add the needed XRD to the pair

- Receive up to 20% as an immediate airdrop by locking your liquidity for up to 12 months

- Earn fees on both your tokens and the XRD

- 100% protected from any XRD impermanent loss

Table of Contents

- Guide: How to provide liquidity to DefiPlaza on Radix

- Why DefiPlaza

- Why Radix

- Details about the Impermament Loss protection

Guide: How to provide liquidity to DefiPlaza on Radix

If you are already on Radix, have the wallet installed, and own at least some XRD, you can proceed to step 3.

Joining a new crypto network is often unfamiliar and a bit scary, because the UX is different from what you are familiar with. Therefor we wrote a step-by-step guide to onboard you to the beautiful world of Radix; a chain designed for user experience and token safety.

So, lets dive right in!

1. Download the Radix wallet

Radix is not an EVM chain and therefor has its own great mobile wallet, combined with a desktop browser extension. A mobile-0nly experience is set to launch in the coming months.

Go to https://wallet.radixdlt.com to set up and download your Radix Wallet using the official links provided there.

Create a new account and connect your wallet to the desktop extension to start interacting with dApps.

Our friends at the HUG meme coin have created a great onboarding video on how to install the wallet. The video below starts at how to download the wallet and install the extension.

2. Get some XRD on to Radix

Now you have your wallet, you need some XRD to pay for the fees.

There are several exchanges available to buy XRD; we prefer RocketX.exchange and will use it in this guide.

You can use RocketX to buy XRD with ETH on Ethereum, SOL on Solana, and many more token and chain combinations. Fees are very reasonable and cross-chain transactions are usually finalized within 30 mins.

The minimum trade size on RocketX is around $30, while you probably only need around $1 or $2, but you can always buy some more assets to provide as liquidity.

3. KYC with Instapass to prepare for bridging

Identity verification via Instapass is required, before you can bridge assets. Radix unfortunately does not have a trustless bridge yet, so this takes some extra time to get done.

Instapass is an official KYC service of Radix that uses industry-leading data security practices and uses service providers, such as SumSub, who are ISO/IEC 27001 compliant.

Please note: due to compliance reasons it is currently not possible to bridge assets if you are a cititzen of the United States of America.

(If you need any assistance, you can contact [email protected])

4. Bridge assets to Radix

After KYC-ing you need to bridge your USDC, USDT, ETH or wBTCs to Radix. You could buy those assets on Radix, but there are not enough wrapped tokens to fulfill the $10M available incentives, so it is probably better to buy them on Ethereum and bridge them to Radix.

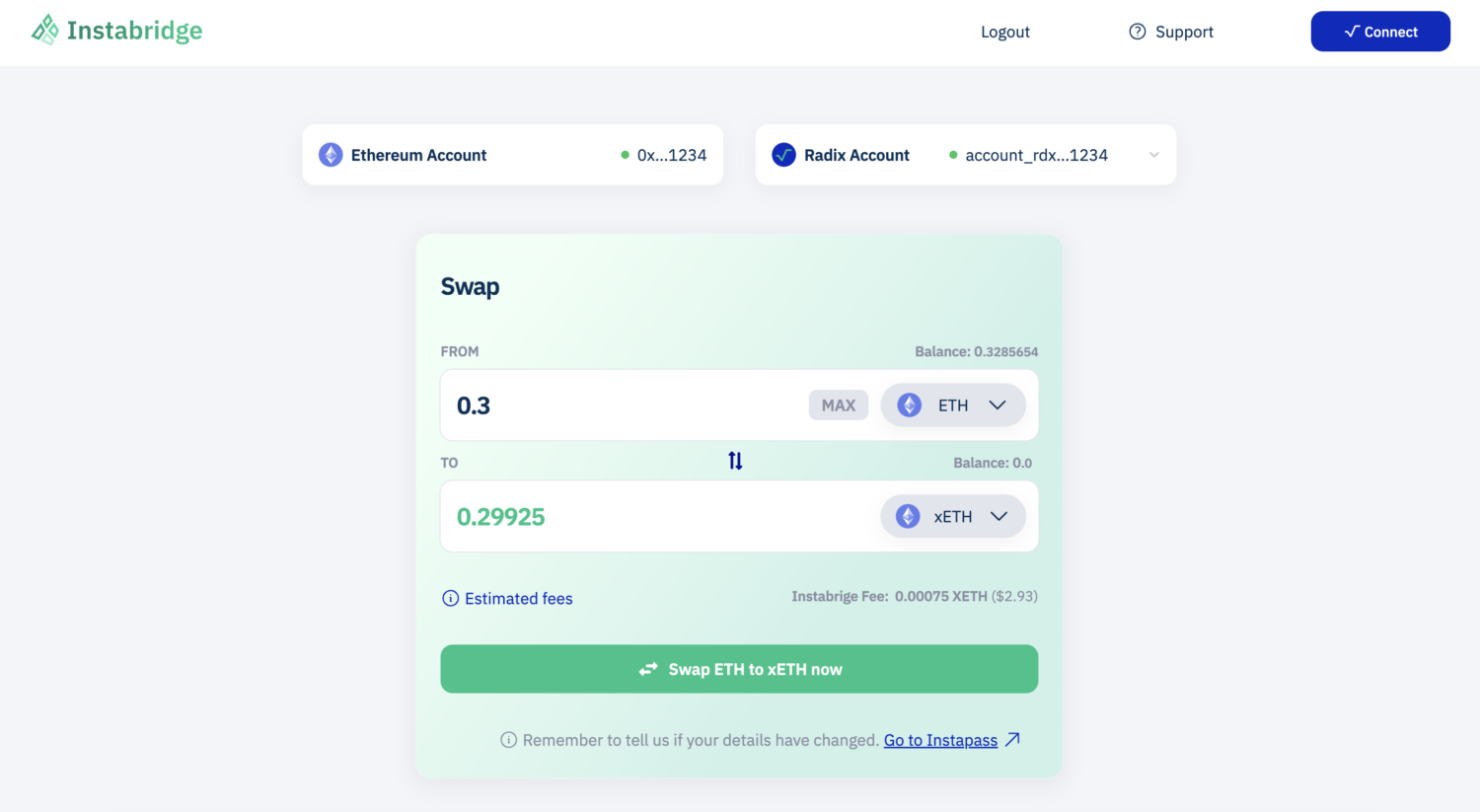

Instabridge is an official Radix bridging service that allows you to send ETH, wBTC, USDC, and USDT to receive wrapped, one-to-one backed versions on Radix. All wrapped assets on the Radix network issued by Instabridge will be designated with an “x” at the beginning (e.g. xETH).

Since this is not a trustless bridge, it might take some time for your assets to become available on Radix.

(If you need any assistance, you can contact [email protected])

5. Provide liquidity to DefiPlaza

The hard parts are over, one final step is left.

DefiPlaza is a next-generation DEX specifically designed to reduce the risk of Impermanent Loss.

To be eligible for the airdrops go to https://radix.defiplaza.net/ignition and pick a pool you want to provide your liquidity to.

As said, you only have to provide your wrapped assets, we take care of any needed XRD to balance your position.

Pick how long you’d like to lock your liquidity. A longer period will give you a higher immediate airdrop of up to 20% of the value you lock.

After you click the button to provide liquidity, open your Radix wallet to approve the transaction.

In the transaction preview, you can see how much you are providing, and what you will get back. Your locked position is represented by an NFT and the airdrop in XRD is visible here too.

Congratulations! 🎉

Why provide liquidity to DefiPlaza?

DefiPlaza is a DEX specifically designed to counter the risk of Impermanent Loss.

DefiPlaza is audited, open-source, and has a white paper explaining the dynamics of our CALM algorithm. A TLDR Twitter thread is also available for a quick intro.

After two years and $80M in trade volume on Ethereum, we learned that Impermanent Loss very regularly swamps any fees earned by Liquidity Providers. So we started on a quest to make a DEX that is sustainably profitable for LPs.

We created CALM, an algorithm that treats trades that create IL differently from trades that reduce IL, thereby reducing the negative impact of impermanent loss.

CALM vastly outperforms traditional methods in terms of bottom-line performance for liquidity providers and we have the numbers to prove it.

Learn more about DefiPlaza at https://defiplaza.net.

Why use Radix?

Radix offers a radically better user and developer experience needed for everyone to confidently use Web3 & DeFi.

Its groundbreaking wallet offers human-readable transaction manifests that make blind signing obsolete and prevent many of the most common mistakes when trading tokens.

The native assets and easy and type-safe programming language Scrypto make creating dApps far easier.

Discover why Radix is radically different at the RadFi 2022 presentation:

Learn more about Radix at https://www.radixdlt.com.

Details about the Impermament Loss protection

DefiPlaza’s CALM algorithm is designed to reduce the risk of Impermanent Loss and works best with a lot of price volatility. It can’t however prevent all IL. Therefor RDX Works added extra IL protection on top of CALM.

In the case of Impermanent Loss there are two scenarios that can happen after your lock-up period is over:

Price of XRD has gone up relative to your assets

The liquidity provider is 100% protected from any IL on XRD, the provided XRD by us takes the hit. So it doesn’t matter whether the price of XRD goes 2x, 20x, or 200x, it has no negative effect on your provided assets (it might even have a positive effect).

Price of XRD has gone down relative to your assets

If your assets out perform XRD, you receive a value guarantee for up to a 4x out-performance (vs XRD) of the asset you provided, and then a sliding amount of asset value protection beyond a 4x change.

So the price of BTC could increase by over 400%, or the XRD price fall by over 75% before your position would be worth less than if you had just held the assets in your wallet. Or, if XRD rises by 2x, BTC can even rise by 8x before any noticable IL occurs.

See here for the full terms and conditions of Project Ignition.