It won’t be surprising to most that we have long thought about expanding to the up-and-coming Radix L1 chain. The move to become a multi-chain platform is not to be taken lightly, but in reality, we have planned for this since we went live with our DEX on Ethereum. And with the community unanimously voting in favor of this expansion, the time has come to unveil our plans for our Radix DEX!

Building a Decentralized Exchange on Radix

We are committed to deploying a decentralized exchange on the Radix public network as soon as the Babylon upgrade (which allows the implementation of smart contracts) goes live. The Radix team has announced Babylon is on track for a release in Q2 2023. That gives us a few months to design, build and test top-notch DEX infrastructure.

Designing a DEX on Radix is a bit like building a flying car. The Radix Engine allows developers to think outside the box and easily build complex smart contracts that are inherently safe from many vulnerabilities that Ethereum suffers from, such as access control mishaps and reentrancy challenges. Moreover, the transaction cost is expected to play a much smaller role on Radix than it does currently on Ethereum.

On Ethereum, the DefiPlaza USP is pretty clear: we are the most efficient DEX on the entire network. On Radix, everyone starts from scratch, and we don’t have many details about the exact fee model yet. It should be cheap for everyone forever is the commitment by RDX Works, but I’m sure that’s what they also thought when they deployed Ethereum.. 🙂

Sustainable DeFi

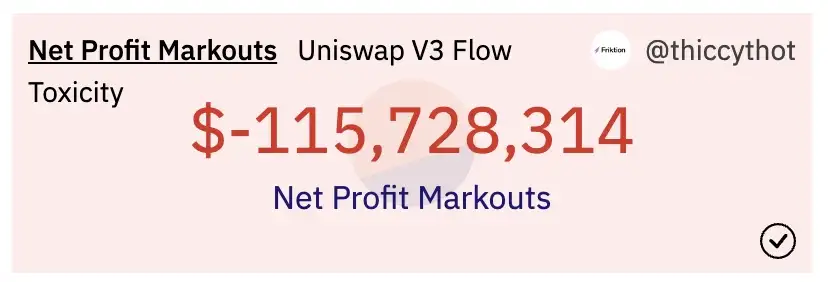

On Radix, the design focus for DefiPlaza will be on sustainable DeFi. That is to say, DefiPlaza aims to provide the service of swapping tokens in a way that can be sustained over the long term by the income it generates. There is much the industry needs to improve in this regard. A recent analysis of the current market leader UniswapV3 has shown performance regarding LP gains is abysmal. For just the WETH/USDC pool alone, the combined losses by LPs have totaled 115M$ to date (end of 2022) as compared to them just holding the same WETH/USDC tokens. Yes, that’s after including LP income from fees!

Even more recently, another study showed that the situation for WETH/WBTC is much more hopeful. Roughly 80% of LPs made a profit compared to just holding the same WETH & WBTC as long as they would provide liquidity for at least 6 months. The much better performance here is due to the price movement over time between ETH and BTC having positively correlated historically, which was one of the motivators for DefiPlaza to use a multi-token pool on Ethereum in the first place.

Key Features

For the design of DefiPlaza on Radix, we will use the insights from our exchange on Ethereum, combined with the insights from the recent studies on LP provision in general. Without going into specifics, we’ll be building on the shoulders of giants, borrowing concepts from Bancor, Dodo, and Curve combined with some new ideas of our own. The below represents an overview of features we are working to include in the exchange. Still, as development is an ongoing process, there may be changes between now and the final Babylon deployment.

Multi-Token Trading

In our Ethereum DEX, we have 16 tokens listed, which means you can trade between 120 unique token pairs without requiring hops from pool to pool as you would need on Uniswap, where liquidity is held in pairs.

On Radix, DefiPlaza will preserve the ability for users to swap between any two tokens and only pay trading fees once. Adding tokens to DefiPlaza may be done trustlessly by any user once the smart contract implementation is deployed. Users may swap between all the popular Radix tokens directly, paying the same single transaction fee.

Single-Sided Liquidity

On our Ethereum DEX, you can already supply and withdraw liquidity single-sided. Effectively you trade against LP tokens when you add/withdraw liquidity. However, while providing liquidity, you own the LP token, which represents a basket of tokens and thus is exposed to price movement for all tokens in that basket.

For DefiPlaza on Radix, we’ll isolate the liquidity token by token. Internally, each token will be paired against DFP2. Thus, the liquidity providers will only be exposed to the price movements of the token provided and the price movement of DFP2. This means that DFP2 gains utility as it is used as the internal grease that keeps the exchange running. Demand for DFP2 will be directly coupled with the success of the exchange.

Concentrated Liquidity

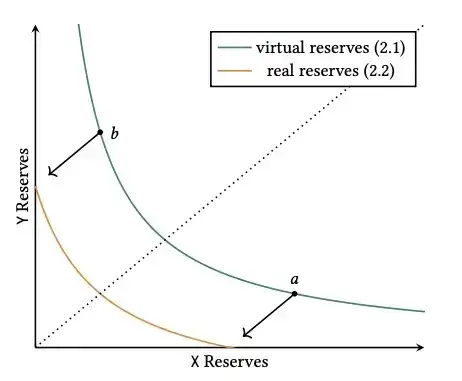

Achieving high capital efficiency is the key to running an efficient exchange. The UniswapV2 algorithm was sustainably profitable originally but couldn’t compete against the high volumes drawn to UniswapV3 and others offering concentrated liquidity. However, getting the degree of liquidity concentration correct is very difficult, as discussed above with the LP performance for the UniswapV3 WETH/USDC pool.

Concentrated liquidity improves capital efficiency but equally increases the risk of Impermanent Loss. DefiPlaza on Radix will automate liquidity concentration and apply it to the degree deemed optimal based on available data and market conditions.

Dynamic Fees

The question of what fee to charge to swapping customers is critical to ensuring long-term sustainability. Set it too low, and fees may not outweigh Impermanent Loss. LP income consists of fee times volume. Maximizing this product means using a low fee when the markets are tranquil and a high fee when there is significant volatility. This is exactly what the DefiPlaza smart contracts will implement.

Token Launch Platform

Finally, a key feature of the Radix DEX will be an integrated token launch platform. This will allow third-party projects to raise funds by launching a new token through an auction mechanism. Successful completion of the auction will result in an immediate listing of the token on DefiPlaza.

As mentioned above, under-the-hood listings are represented as pairs with DFP2. This means that a certain amount of DFP2 needs to be supplied when a token is listed to facilitate bidirectional trading.

Experiment & Validate

The above summarizes what we plan to implement once the Babylon upgrade becomes available. In the interim, we want to use the time for development, testing, and data gathering. Thus, the DefiPlaza team will deploy a centralized version of the DEX prior to launching the real deal!