Anchored liquidity is a feature of the StablePlaza pool.

Anchored liquidity is a special case of concentrated liquidity as introduced by Uniswap V3.

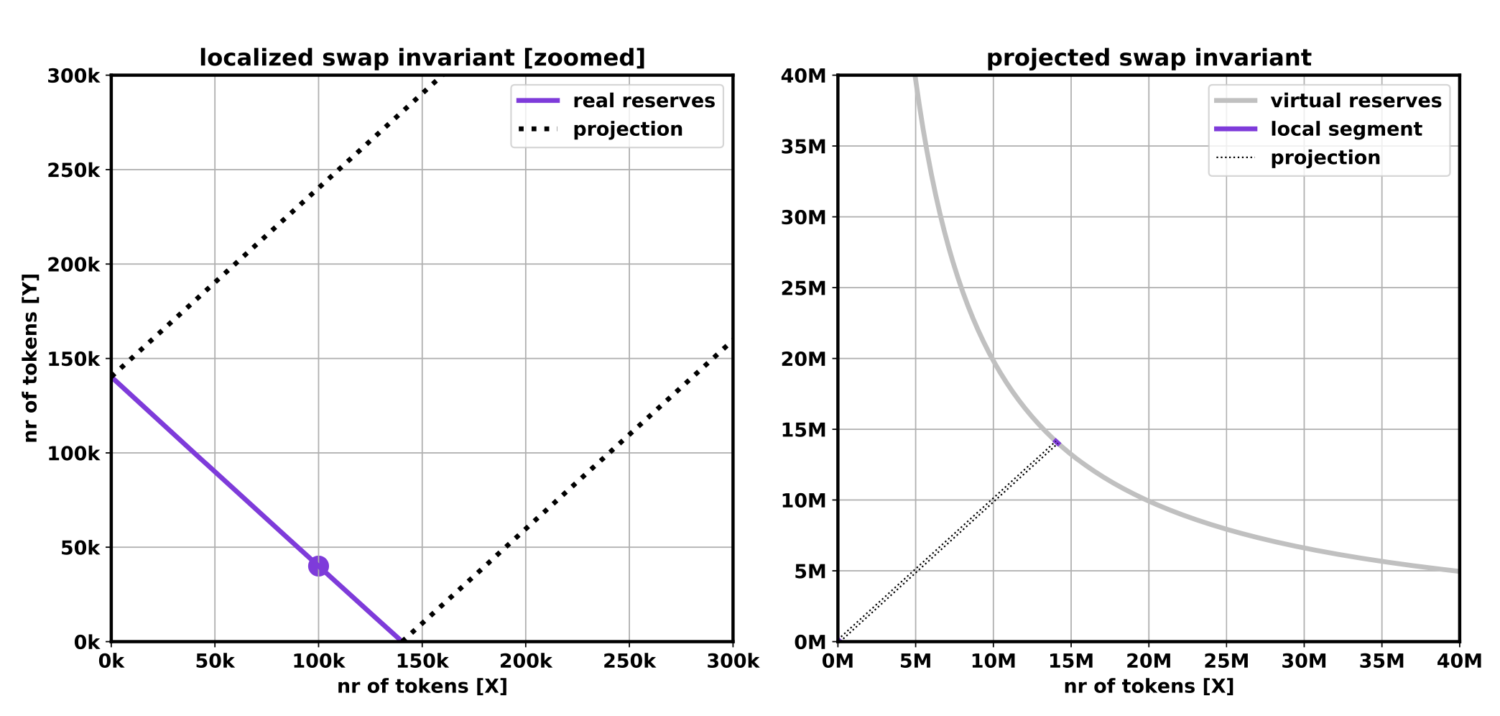

The idea of concentrated liquidity is that LPs can select a price range [a, b] on the constant product hyperbole and their liquidity would only be active when the price is within that range.

The name ’anchored liquidity’ is chosen because the amount of virtual liquidity is set specifically in such a way that the price ratio between the tokens is anchored to a certain range regardless of how many reserves are held by the exchange for each token.

You can read more about the details of anchored liquidity in our StablePlaza White Paper.